This blog has been produced in partnership with CIBC.

As you continue to take steps toward building your life in Canada, the next things you do will involve bringing the rest of your money to build your new home. You may encounter a few roadblocks. Some may even be scams! These tips will help you protect your financial future.

Bringing Your Money to Canada

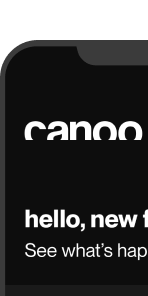

In preparing for your move, you likely saved enough to sustain yourself for at least the first few months, if not longer. If you didn’t bring your entire savings over with you, you can still access it easily from Canada. Your options include wire transfers, alternative assets, and cash. Considering these, Canadian banks, like CIBC, have a wide variety of services to help you bring your money to Canada so that you can begin your next chapter.

If you have your funds in a bank in your home country, you can send them via wire transfer after opening a bank account in Canada. Bringing cash in Canadian currency or other currencies is also an option.

While there are additional opportunities to bring over assets, like bonds, treasury bills, and stocks, it is important to ensure that the bank you choose in Canada can cash out these types of items for you.

You may also have different types of items that hold value. Whether that value is monetary or not, these items are important and can be stored safely. At CIBC, you can store any valuable items when you open a CIBC Smart AccountTM for Newcomers. This is done through a safety deposit box that you can access whenever you need.

Click here for more information on how you can bring your money to Canada.

Facing Fraud and Scary Scams

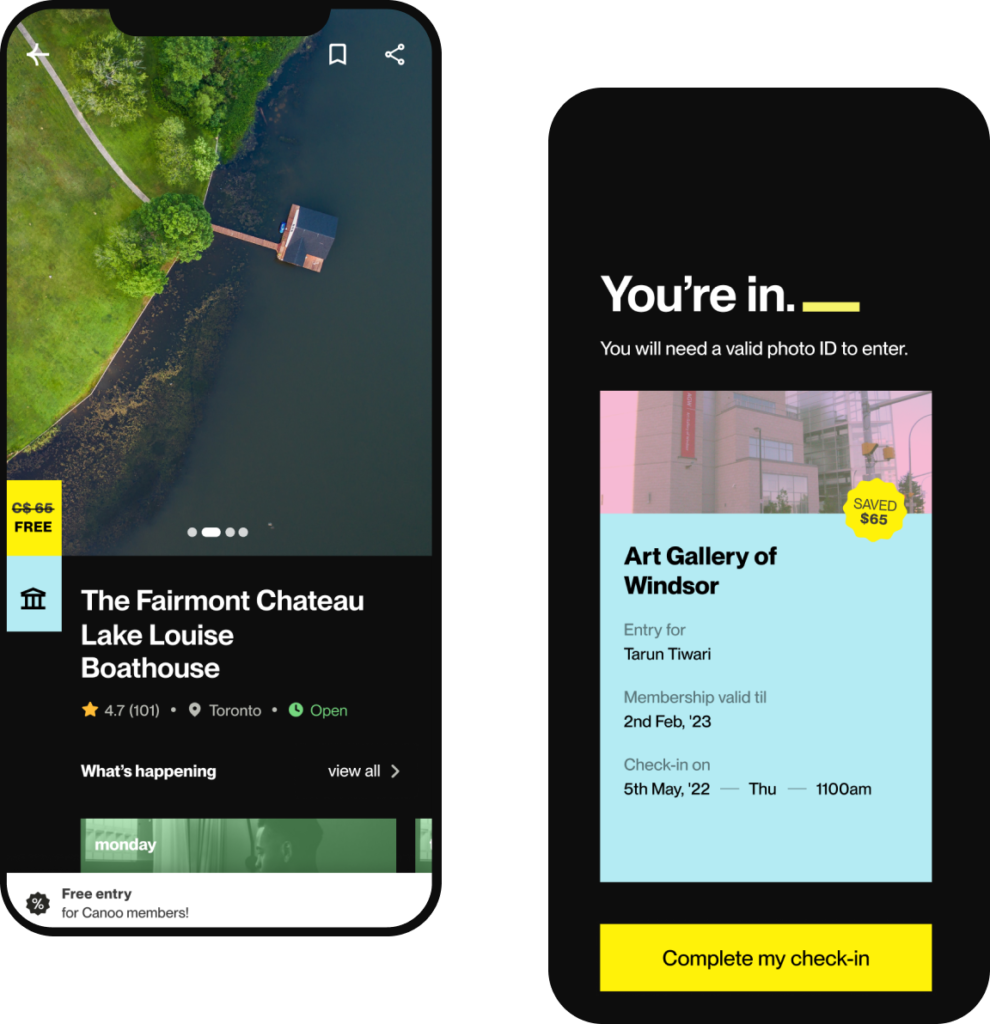

Unfortunately, it’s common to receive fraudulent calls from an unknown number facing an urgent situation that you must resolve by providing personal information. These are often scams! Scams can be very obvious and can also very subtle – this makes them dangerous. Here are a few examples of fraudulent schemes to be wary of in the future:

1. Telephone Scams

Beware of unexpected callers or automated voice calls claiming to be from established organizations like banks or the Canada Revenue Agency (CRA). Do not share sensitive details, such as bank passwords or Social Insurance Numbers (SIN) through these phone calls. These scammers will try to prey on your stress and empathy. So, if you feel uncertain about an incoming call, that is your intuition telling you something fishy is going on!

2. Money Mule Scams

This type of scam occurs when scammers befriend individuals online, then trick them into depositing funds and transferring money to the fraudster’s account. Eventually, victims are left with significant losses. Some key signs to look out for here are having never met the person who’s asking you to make the transfer, being asked to refund the difference on an overpayment, or the person cutting off contact almost immediately after you have sent money to them.

3. Phishing

Phishing scams use emails, texts, or calls that mimic trusted sources to gain your trust and obtain personal information. These messages often resemble legitimate businesses, colleagues, etc. Once they obtain your data, they can exploit it for financial gain or, in extreme cases, identity theft.

Top Tips for Fraud Prevention

- Canadian banks, like CIBC, will not ask for personal information over text or email, so always be wary!

- Use antivirus software on devices, so you don’t come into contact with harmful malware.

- Update your passwords regularly.

- Never respond to urgent requests for money or information from unfamiliar sources. If you receive emails or texts, investigate the sender’s details. Keep an eye out for things like threats and spelling or grammar mistakes.

- Set up transaction alerts for your bank accounts and credit cards so that you closely monitor all the activity.

Click here to learn about other examples of fraud and how you can prepare yourself.

Your Next Step: Building Credit Score

In avoiding scams, you are also protecting your credit score. Credit Scores are three-digit numbers based on whether you have missed payments, if you make your payments on time, any debt you may have, and so on. A low or bad credit score is under 660 and a high or good credit score is above 750. Many good-standing credits also lie within the 660 – 750 range.

When you pay on time and stay within your credit limit, you are taking steps towards a good credit score! This will be helpful when you are involved in competitive renting options or applying for business loans and mortgages.

Click here for more information on how you can improve your credit score in the future.

By staying informed and adopting smart financial habits, you’re not just protecting yourself, you’re investing in your future here in Canada. So, keep those financial smarts sharp and watch your opportunities grow!